The Unbanked Population is a Major Socio-Economic Challenge

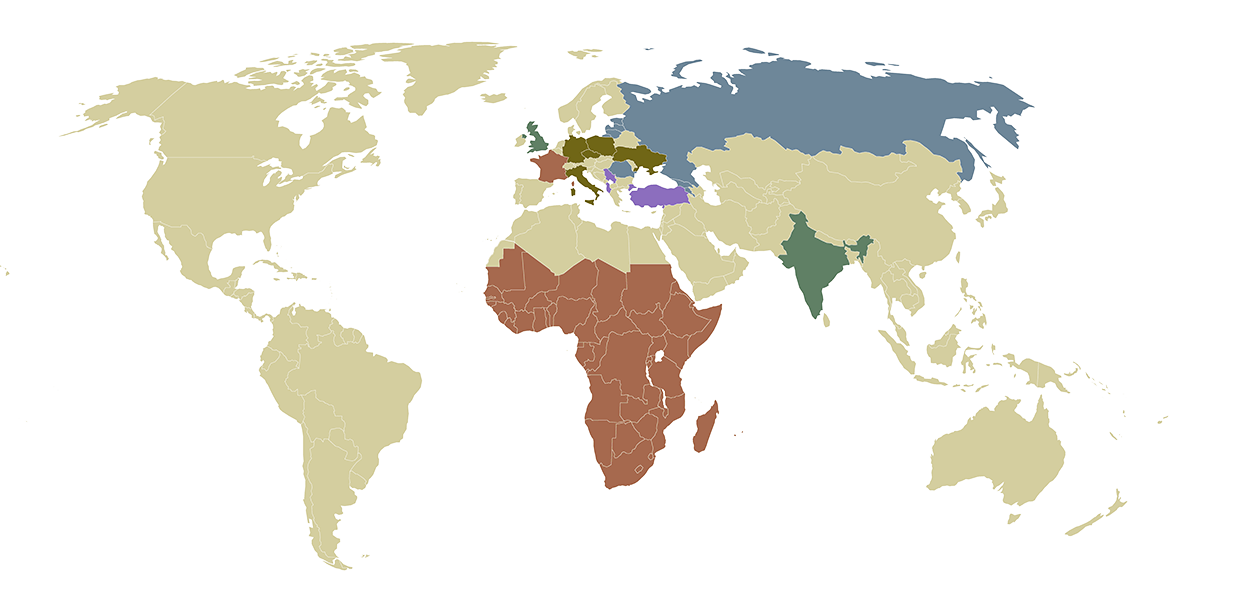

Just over half of the world’s adult population, 2.5 billion adults, do not use formal financial services to save or borrow money*. Nearly 2.2 billion of these unserved adults live in Africa, Asia, Latin America, and the Middle East. Unserved, however, does not mean unservable.

Large unserved populations represent opportunities for Fintech Ventures to offer an innovative range of high-quality, affordable financial products and services. Moreover, with the right financial education and support to make good choices, lower-income consumers will benefit from credit, savings, insurance, and payments products that help them invest in economic opportunities, better manage their money, reduce risks, and plan for the future. The goal of financial inclusion appears to be within reach. Fintech Ventures is committed to bridge the socio-economic gap with banking. Our remittance focused portfolio company Spoko, has besides a potential unicorn, the ability to serve as a motor for our mission.

*Source: McKinsey research conducted in partnership with the Financial Access Initiative

The Synergy Between Remittance And Socio-Economic Impact

During challenging times, remittances act as a respite not only for families but also for the economy. Macroeconomically, regular remittance inflow helps improve the balance of payment and keeps borrowing costs low. At a microeconomic level, remittances enable families to maintain their lifestyle and channelize funds towards education and investment opportunities. In other words, remittances have enabled families in developing countries to maintain or even improve their purchasing power. The presence of an additional channel of income, in the form of remittances, could be attributed as the premise for globalization in developing economies.

The prominence of remittances and their role in globalization have steadily increased as the number of migrants nearly doubled in the three decades starting 1990. Thriving economies tend to attract expats, as a stronger currency promises better standards of living and opportunities for their loved ones. When expats send money home, they are mostly passing on economic vibrancy to their home country. Remittances are utilized by their families in the health and education sectors and also streamlined towards investments. Thereby, remittances become a crucial factor in driving global capital circulation.

In the foreseeable future, remittances may remain dominant in the global economy and continue to be an impetus to globalization.

Bridging the socio-economic gaps with remittance

Over 800 million people are solely dependent on the remittance income sent back home by their loved ones. Money sent by expats to their home country has become a significant source of external aid, and an essential element of economic growth for many developing nations.

Ensures customer flow through remittance

Remittance is our focal point and engine for driving customer flow. With our company Spoko we have an outstanding platform. Spoko will be present in 42 low-income countries and have over 1 million customers in 2021. This flow of customers and traffic creates endless conditions for further capitalization.

Global remittances witnessed a 5% growth in 2019 to US$554 billion to LMICs (low- and middle income countries). The growth rate is expected to increase.

Over the last few years, the remittance industry has introduced digital innovations to cater to the needs of its evolving customers. The rampant adoption of mobile wallets and other technologies will play a pivotal role in fostering the growth of the remittance industry. While the remittance volumes both in terms of capital and customers are increasing, the operator margins are decreasing. The average remittance fee rates has dropped from 10% to 6.82% (2019). With the promise of enabling an inclusive community, Spoko is looking to bring pricing as a competitive edge.

On one hand, this development helps support the mission of Fintech Ventures, allowing expats to send home a substantial portion of their income affordably. Money sent by expats to their home country has become a significant source of external aid, and an essential element of economic growth for many developing nations.

On the other hand, this margin pressure in symbiosis with digital innovations within the remittance industry foster the strategy of Fintech Ventures – utilize Spoko’s flow of customers to offer ancillary services to a large customer base where the long-term earning capacity is secured.